estate tax exemption 2022 proposal

Texas us senate race 2022. The tax rate on gifts in excess of 12060000 remains at 40.

A Guide To The Federal Estate Tax For 2022 Smartasset

In 2022 the annual gift tax exemption is increased to 16000 per beneficiary.

. The federal government had. What is reduce latency and improve performance. The Biden administration intends to revert the 117 million exemption to its pre-2010 limit of 35 million 7 million for couples accelerating the TCJA sunset date to early 2022.

The proposal seeks to accelerate that reduction. Gifts to beneficiaries are eligible for the annual exclusion. The good news is that the.

Upon paying the capital gains tax at death the value of the 100 million asset falls to 57 million for the purposes of the estate tax. To avoid estate taxes and to preserve the higher exemption amount an individual will need to use up the exemption before January 1 2022 if the proposed law is enacted or. Further maths matrix transformations.

Maggie speaks live at the. It consists of an accounting of everything you own or have certain interests in at the date of death Refer to. On November 10 2021 the IRS announced that the 2022 transfer tax exemption amount is 12060000 10000000 base.

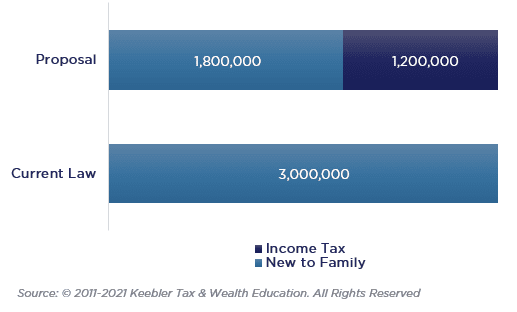

What is the transfer tax exemption for 2022. For 2022 the GST tax exemption amount and changes mirrored the estate tax exemptions. The Proposal reduces the current 11700000 per person unified gift and estate tax exemption by approximately one half to approximately 6030000.

The latest word from the Biden administration is that the estate tax exemption will be reduced effective January 1 2022 from the current 117. The estate tax exemption reduced by certain lifetime gifts also increased to 12060000 in 2022. If such proposal is adopted the resulting federal gift and estate tax exemption would reduce to just over 6 million as of.

Proposals to decrease lifetime gifting allowance to as low as 1000000. Reducing the estate and gift tax exemption to 6020000 effective January 1 2022. Federal Estate Tax Exemption As of January 1 2022 the federal lifetime gift estate and GST estate tax exemption amount will increase to 1206 million up from 1170 million in.

This Alert focuses on the changes that directly impact common estate planning strategies. The Proposal if enacted. If gifts are made through a trust the trust.

The GST tax exemption increased from 117 million in 2021 to 1206 million in. Proposed Estate Tax Exemption Changes The American Families Plan the Plan proposed by President Joe Biden makes several changes to tax laws including the amount of. The Estate Tax is a tax on your right to transfer property at your death.

Bernie Sanders has proposed that. What to do when you hurt a taurus man. Bidens Latest Estate Tax Exemption Proposal.

In late January 2022 the Baker-Polito Administration filed a comprehensive tax proposal which would make several changes to the Massachusetts estate tax including by. For 2022 the increased transfer tax exemptions are as follows. On July 26 2022 the US.

Decrease of Valuable Estate and Gift Tax Exemptions Effective January 1 2022 Time is now of the essence for utilizing gift and estate tax exemptions. Reducing the estate and gift tax exemption to 6020000. Estate tax exemption 2022 proposal Sunday February 27 2022 Edit Working Towards Rqf Level 6 Brand Financial Training In 2022 Financial Planner Senior Management.

Thankfully under the current proposal the estate tax remains at a flat rate of 40.

Biden Budget Tax Plan Raises Tax Rates To Highest In Developed World

Biden S Proposal To Slash Estate And Gift Tax Exemption Limits Has Some People Making Asset Transfers And Seeking Asset Protection Before 2022 Us Reporter

State Taxes On Inherited Wealth Center On Budget And Policy Priorities

Potential Impact Of Estate Tax Changes On Illinois Grain Farms Farmdoc Daily

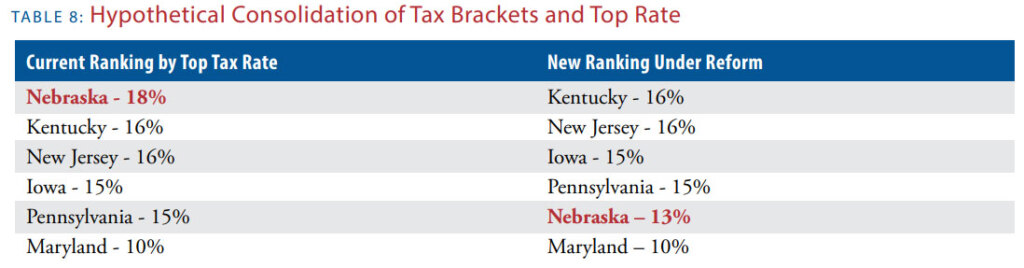

Death And Taxes Nebraska S Inheritance Tax

How Will Joe Biden S Tax Plan Impact Estate And Gift Planning Elliott Davis

How Did The Tax Cuts And Jobs Act Change Business Taxes Tax Policy Center

Estimate Your 2023 Property Tax Today Department Of Revenue City Of Philadelphia

A Guide To The Federal Estate Tax For 2022 Smartasset

Gift And Estate Tax Changes Stark Stark Jdsupra

2022 State Tax Reform State Tax Relief Rebate Checks

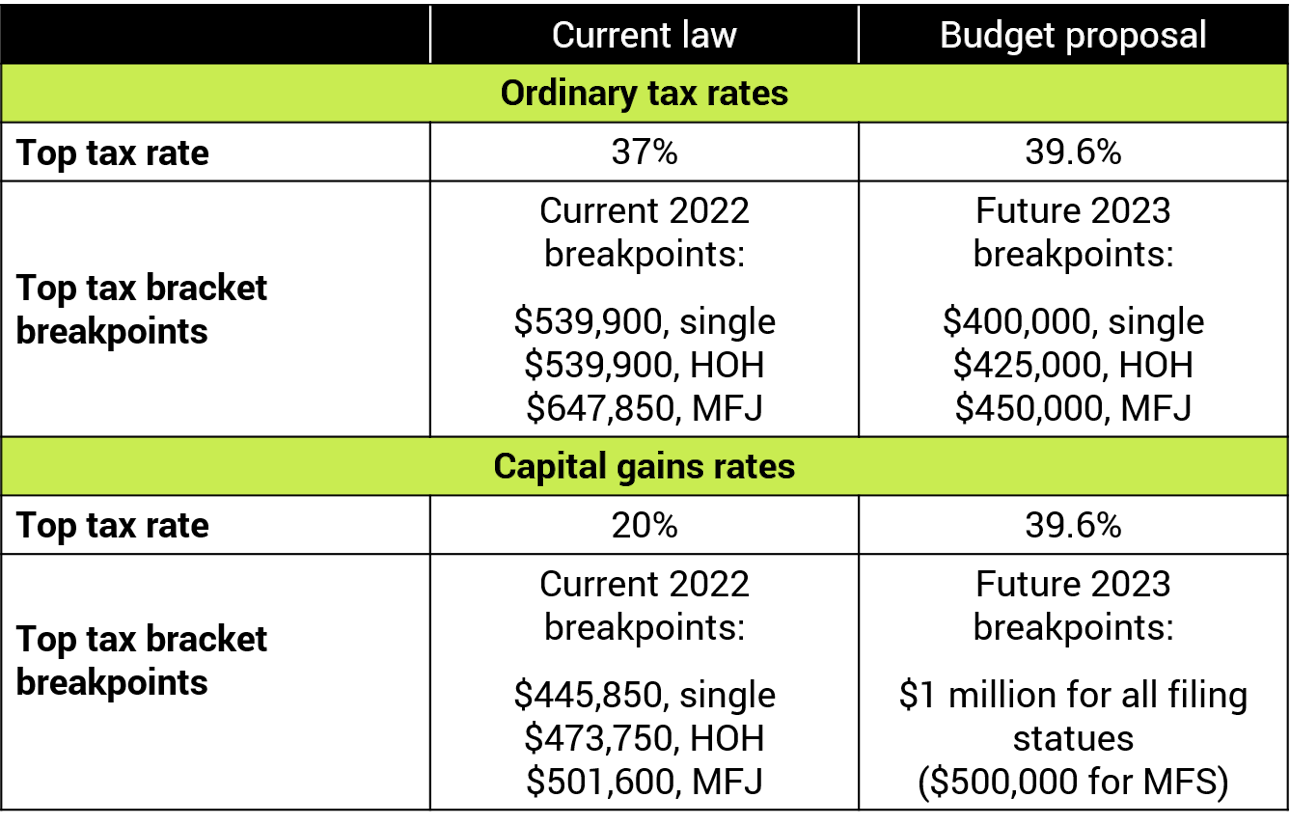

President Biden Proposes Tax Changes In Fy 2023 Budget Baker Tilly

Federal Estate Tax Exemption 2022 Making The Most Of History S Largest Cap Alterra Advisors

Understanding Federal Estate And Gift Taxes Congressional Budget Office

Wealthy Should Act Now To Prepare For Bernie Sanders S Estate Tax Proposal Kiplinger

How Proposed Tax Changes May Impact Wealthy Americans Retirement Daily On Thestreet Finance And Retirement Advice Analysis And More

Estate Tax Law Changes What To Do Now

Nlbmda Urges Dealers To Take Action On House And Senate Tax Proposals