cash app taxes law

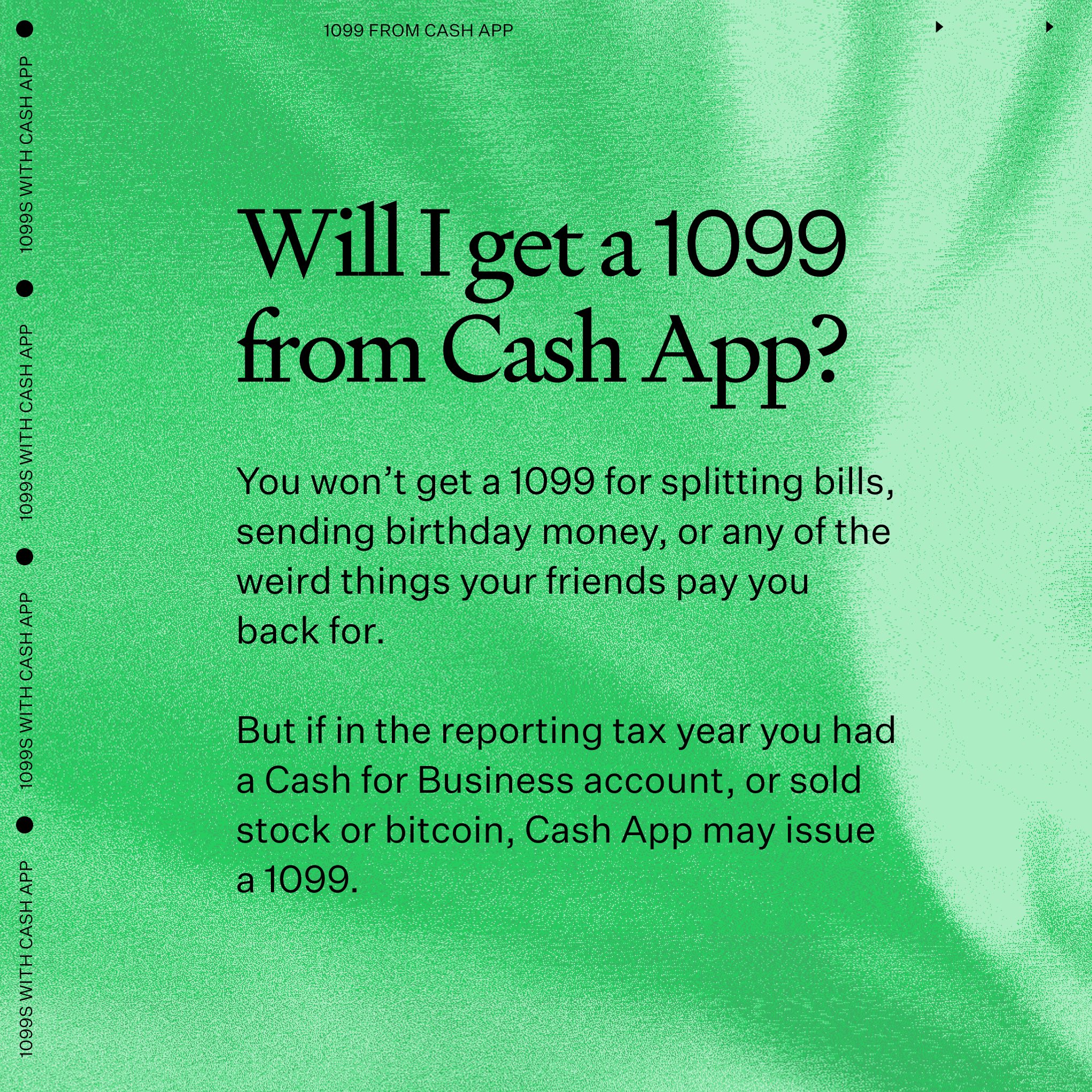

Payment app providers now must issue you and the IRS a Form 1099-K on your business transactions if combined they total more than 600 a year. Beginning this year Cash app networks are required to send a Form 1099-K to.

Paypal And Venmo Taxes What You Need To Know About P2p Platforms Turbotax Tax Tips Videos

Under California law tips are not technically a wage paid by the employer8 Although for tax purposes most types of tips are considered taxable income the same as.

. Third-party payment processors like Venmo PayPal and Cash App are now required to report a users business transaction to the IRS if they exceed 600 for the year. California Income Tax Calculator 2021. Starting January 1 2022 if your Cash for Business account has 600 or more in gross sales in the 2022 tax year it will qualify for a Form 1099-K and Cash App is required to report it to the IRS.

Your average tax rate is 1198 and your marginal. Now Cash App and other third-party payment. If you make 70000 a year living in the region of California USA you will be taxed 15111.

Under California law employees have the right to keep their tips. SUBSCRIBE RING THE BELL for new videos every day Follow my VLOGS here. A fair and equitable cash for keys agreement will mutually benefit both the new owner of the property and the resident former owner or tenant residing in the property.

Payment app providers now must issue you and the IRS a Form 1099-K on your business transactions if combined they total more than 600 a year. Will Cash App be impacted by the new rule on reporting business transactions to the IRS. It used to be they only.

New Cash App Tax Reporting for Payments 600 or more Under the prior law the IRS required payment card and third party networks to issue Form 1099-K to report certain. But sometimes customers add the tip onto their. As of Jan.

1 mobile payment apps like Venmo PayPal and Cash App are required to report commercial transactions totaling more than 600 per year to the Internal Revenue. Now cash apps are required to report payments totaling more than 600 for goods and services. Those posts refer to a provision in the American Rescue Plan Act which went into effect on January 1 2022 according to which anyone receiving 600 per year using Venmo.

The law amended some sections of the Internal Revenue Code requiring TPSOs to report goods and services transactions made by users with 600 or more in annual gross. 2022 the rule changed. It used to be they only.

The owner of the salon encourages customers to leave tips in cash.

Tax Law Changes Could Affect Paypal Venmo And Cash App Users

What Cash App Users Need To Know About New Tax Form Proposals Verifythis Com

Venmo Cashapp And Other Payment Apps Face New Tax Reporting Rule Cnn Business

![]()

Portfolio Dave Chung Content Strategist Ux Writer In Denver

Cash App On Twitter Questions About Cash App And 1099s Here Is A Thread Https T Co Coruglxz17 Twitter

New Tax Rule Requires Paypal Venmo Cash App To Report Annual Business Payments Exceeding 600

Here Are The Tax Changes Coming To Venmo Cash App Paypal And Other Apps Forbes Advisor

Cash App Business Account Your Complete 2022 Guide

Cash App Income Is Taxable Irs Changes Rules In 2022

Cash App Taxes 2022 Tax Year 2021 Review Pcmag

What Is Cash App Pros Cons Features Nextadvisor With Time

Cash App Taxes 100 Free Tax Filing For Federal State

Cash App Taxes How To See Youtube

New Tax Laws 2022 Getting Paid On Venmo Or Cash App This New Tax Rule Might Apply To You Abc7 New York